Apart from this deduction, you can claim deductions for short-term capital gains on shares and long-term capital gains. The maximum deduction under 80C is ₹1,50,000. Beyond that limit, you are not eligible to claim these deductions. You can claim only a specified amount under each deduction, some of which cannot exceed the maximum limit set by the IT department. Subscription to equity shares or debenturesĬontribution to pension scheme of Government of India (GOI)ĭeduction on interest for residential house property Some deductions under 80C are:Ĭontribution to an approved superannuation fund

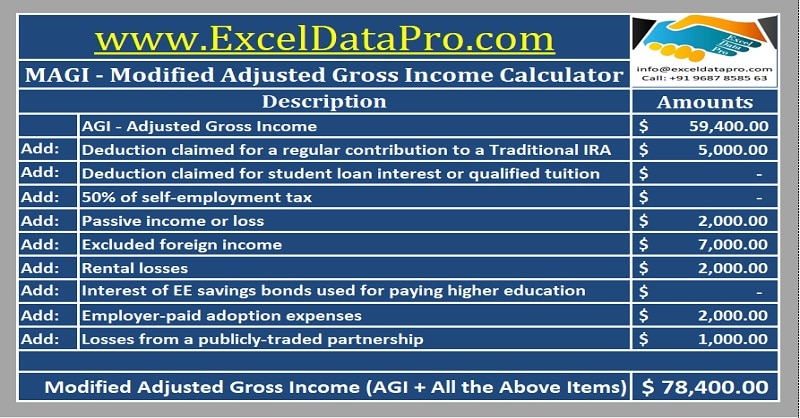

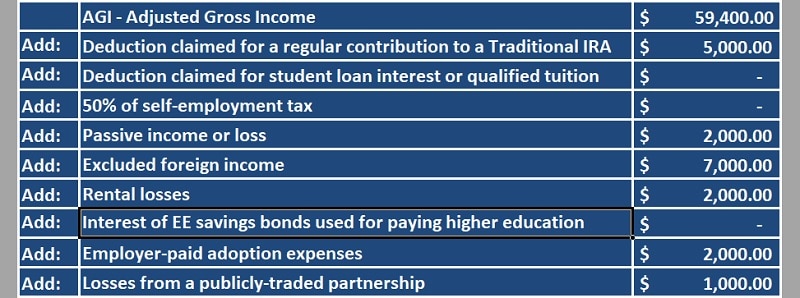

The next step is identifying the eligible deductions under the income tax law. Related: What Is Self Employed? Benefits, Types And Examples 2. The total amount you earn from your business-related sources forms the gross income. You can include business revenue generated from selling the company's shares or income you generate from selling property or surplus equipment, interest or fees. Self-employed professionals identify their gross income based on profits and financial gains. Related: What Is Salary Breakup? Why It Is Important To Know Business professional You might find some of this information in Form 16A. Add these to your gross income if you work in multiple jobs or have other incomes from rental property, interest income, capital gains or losses, alimony or bonds. You can include other benefits, such as incentives, overtime, gratuity, salary arrears, subsidised meal coupons and employer-paid utility bills. If you are employed, your employer may likely provide you with Form 16, which includes details about your gross income and other bonuses. The calculation of gross income varies depending upon whether you are a salaried employee or business professional: Salaried employees Calculating the AGI is essential for filing the income tax with the IT department. Related: Gross Income: What It Is And How To Calculate It Per Month How To Calculate Your Adjusted Gross IncomeĪGI depends upon your gross income, including any financial earnings you accrue during a financial year. Calculating AGI is essential because it identifies your eligibility for tax deductions. For AGI, amounts are deductible under sections 80CCC to 80U but not under section 80G. AGI is an important figure on the tax return because it helps the IT department identify how much taxes and what benefits and tax deductions you are eligible for. Calculating your AGI makes it easy to determine how much income is taxable after making these deductions. Adjusted gross income refers to the gross income minus specific deductions offered by the Income Tax (IT) department.

0 kommentar(er)

0 kommentar(er)